Firearm and Accessory Sales Trends in Q1 2025

The first quarter of 2025 has solidified a multi-year downturn in U.S. firearms and accessory sales, with total gun purchases falling to approximately 3.8 million units—a 12% decline compared to Q1 2024. This contraction reflects broader macroeconomic pressures, market saturation from the 2020–2023 buying surge, and shifting consumer preferences toward specialized products. For Federal Firearms Licensees (FFLs), adapting to these trends requires a nuanced understanding of which categories retain demand, which are faltering, and how pricing strategies intersect with evolving buyer behavior.

Market Overview: Contraction and Consolidation

Declining Volumes Amid Economic Uncertainty

U.S. firearm sales in Q1 2025 totaled roughly 3.8 million units, extending a downward trajectory that began in late 2023. This represents a 12% year-over-year drop from Q1 2024 and a 42% decline from the pandemic-driven peak of 2020. Ammunition sales followed suit, with major manufacturers like AMMO, Inc. reporting a 9.6% revenue decrease in their ammunition segment ($18.7 million in Q1 2025 vs. $20.8 million in Q1 2024). The average price per firearm remained stable at $680–$720, though consumers increasingly prioritized modular designs and concealed carry-ready models over premium-priced tactical rifles.

Legislative and Cultural Drivers

The Biden administration’s focus on renewing the assault weapons ban—though stalled in Congress—has dampened enthusiasm for semi-automatic rifles, while state-level “red flag” laws in markets like Washington and Illinois have further suppressed sales. Conversely, the Supreme Court’s anticipated ruling on New York State Rifle & Pistol Association v. Bruen (expanding concealed carry rights) has sustained interest in compact handguns and holster systems.

Fastest-Selling Product Categories in Q1 2025

1. Concealed Carry Pistols

The SIG Sauer P365 retained its dominance as the best-selling firearm overall, with Q1 2025 sales rising 8% year-over-year. Its micro-compact design, 10+1 capacity, and aftermarket support (e.g., interchangeable grip modules) made it a favorite among both new buyers and existing owners seeking upgrades. Competitors like the Glock 43X and Smith & Wesson Shield Plus similarly outperformed the broader market, driven by urban buyers prioritizing self-defense.

2. .22 LR Training and Plinking Rifles

The Ruger 10/22, a perennial leader in rimfire sales, saw a 5% sales increase in Q1 2025 as recreational shooters sought affordable practice options. Ammunition costs for centerfire cartridges (e.g., 9mm, .223 Remington) have risen 14% since 2024, making .22 LR an economical alternative for training. Bundling rifles with optics-ready rails and introductory ammunition packages proved effective for retailers.

3. Smart Firearm Accessories

Innovations showcased at SHOT Show 2025 drove demand for tech-enhanced accessories. The ClayCopter automated clay launcher (adjustable flight patterns up to 100 yards) and TrackingPoint’s Bluetooth-enabled scopes (real-time ballistic data syncing) emerged as top sellers, particularly among competitive shooters and hunting enthusiasts.

Steepest Declines: Categories Losing Traction

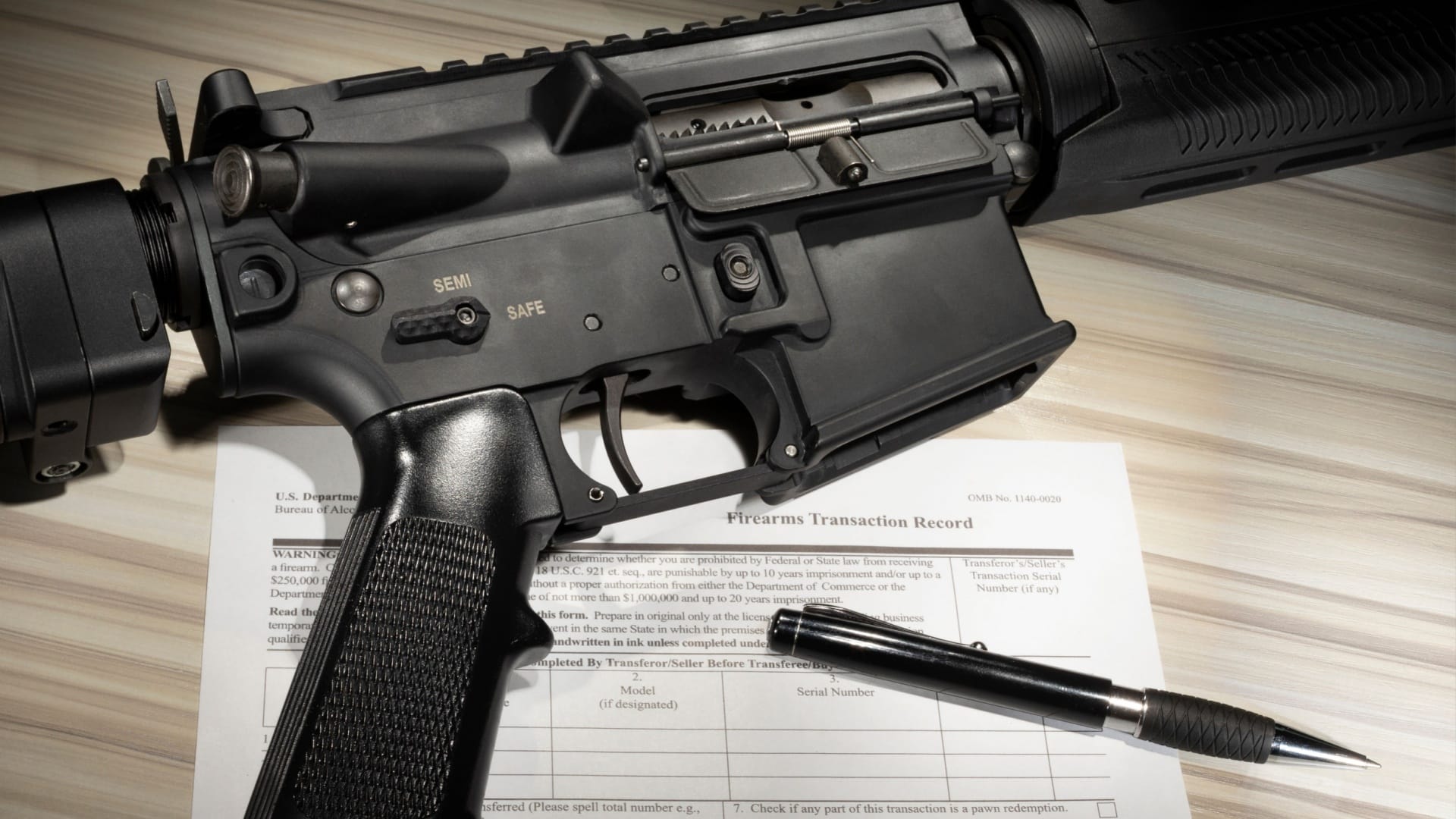

1. High-Capacity Semi-Automatic Rifles

Sales of AR-15-platform rifles fell 22% in Q1 2025, reflecting both political uncertainty and market saturation. Over 14 million AR-style rifles entered circulation between 2020 and 2023, leaving fewer first-time buyers. Proposals to ban rifles with detachable magazines exceeding 10 rounds (Category A7 under the revised EU Firearms Directive) further chilled demand, despite the U.S. lacking comparable federal restrictions.

2. Pump-Action Shotguns

Once a staple for home defense, pump shotguns like the Mossberg 500 and Remington 870 declined 18% year-over-year as buyers shifted toward semi-automatic models with reduced recoil and faster follow-up capabilities.

3. Bulk Ammunition Packs

Economic pressures reduced discretionary spending on bulk ammunition (1,000-round cases), with sales falling 15% compared to Q1 202. Consumers instead purchased smaller 50- or 100-round boxes, prioritizing immediate needs over stockpiling.

Pricing and Accessory Trends

Average Firearm Price: $680–$720

Mid-priced handguns ($500–$800) accounted for 64% of Q1 2025 transactions, while premium rifles ($1,500+) represented just 9% of sales. This reflects a focus on practical utility over collectibility.

Top-Performing Accessories

-

Modular Upgrades: Aftermarket slides, threaded barrels, and optic-cut plates for SIG P320/P365 and Glock platforms.

-

Training Tools: Laser-emitting cartridges (e.g., LASR software-compatible rounds) and recoil-reducing muzzle devices.

-

Concealed Carry Solutions: Appendix Inside-the-Waistband (AIWB) holsters with adjustable cant and breathable materials.

Strategic Recommendations for FFLs

1. Prioritize Concealed Carry Inventory

Stock micro-compact pistols from SIG Sauer, Glock, and Smith & Wesson, emphasizing their suitability for urban self-defense and state-level permit reciprocity. Offer complimentary concealed carry permit courses to drive foot traffic.

2. Bundle Affordable Training Packages

Pair .22 LR rifles with entry-level optics and ammunition subscriptions (e.g., monthly 500-round deliveries). Highlight the Ruger 10/22’s aftermarket support for customization.

3. Clear Excess Rifle and Shotgun Inventory

Discount slow-moving AR-15s and pump shotguns by 10–15%, bundling them with free range passes or cleaning kits. Emphasize their utility for home defense to counteract negative media narratives.

4. Showcase Smart Accessories

Dedicate store displays to tech-driven products like the ClayCopter and electronic ear protection with Bluetooth. Host demo days to familiarize customers with these innovations.

5. Leverage Consignment Sales

Encourage customers to trade in lightly used firearms for store credit, then resell these at a 20–30% discount. This attracts budget-conscious buyers without sacrificing margins.

Conclusion: Adapting to a New Normal

The U.S. firearms market has transitioned from panic-driven growth to selective, value-oriented purchasing. For FFLs, success in 2025 hinges on curating inventory to match shifting self-defense priorities, promoting training and accessories over standalone firearm sales, and leveraging consignment models to serve cost-sensitive buyers. While legislative risks persist, retailers who emphasize adaptability and customer education will withstand the downturn—and position themselves to capitalize when demand rebounds.

https://shorturl.fm/amSRr

https://shorturl.fm/Ezhm5

https://shorturl.fm/x6tYg

https://shorturl.fm/mZ5CS

https://shorturl.fm/sxKJ6

siteniz çok güzel devasa bilgilendirme var aradığım herşey burada mevcut çok teşekkür ederim

siteniz harika başarılarınızın devamını dilerim aradığım herşey bu sitede

siteniz çok güzel devasa bilgilendirme var aradığım herşey burada mevcut çok teşekkür ederim

siteniz çok güzel devasa bilgilendirme var aradığım herşey burada mevcut çok teşekkür ederim

siteniz çok güzel devasa bilgilendirme var aradığım herşey burada mevcut çok teşekkür ederim

siteniz bir harika ben çok beğendim ve gerçekten çok güzel bilgilendirme var diğer sitelerden çok önde ve ben bundan sonra sürekli ziyaret edeceğim

Harika bir yazı olmuş, teşekkürler. Özellikle Bursa’nın yoğun trafiğinde neyle karşılaşacağımız belli olmuyor. Olası bir durumda elimde kanıt olması için kaliteli bir bursa araç kamerası almayı düşünüyorum. Bu yazı karar vermemde çok yardımcı oldu.

Bilgiler için çok sağ olun. Ben özellikle park halindeyken de kayıt yapabilen bir model arıyordum. Nilüfer gibi kalabalık yerlerde park etmek büyük sorun. Sanırım benim için en ideali hareket sensörlü bir bursa araç kamerası olacak.

Geçen ay küçük bir kazaya karıştım ve haklı olmama rağmen ispatlamakta zorlandım. O günden sonra hemen bir bursa araç kamerası araştırmaya başladım. Keşke bu olayı yaşamadan önce bu yazıyı okuyup önlemimi alsaydım.

Ben profesyonel olarak direksiyon sallıyorum ve güvenlik benim için ilk sırada. Şirket araçlarımızın hepsinde olduğu gibi şahsi aracıma da bir bursa araç kamerası taktırmak istiyorum. Hem caydırıcı oluyor hem de olası bir durumda sigorta süreçlerini hızlandırıyor.

Harika bir yazı olmuş, teşekkürler. Özellikle Bursa’nın yoğun trafiğinde neyle karşılaşacağımız belli olmuyor. Olası bir durumda elimde kanıt olması için kaliteli bir bursa araç kamerası almayı düşünüyorum. Bu yazı karar vermemde çok yardımcı oldu.

Daha önce araç kamerası kullanma konusunda tereddütlerim vardı, gereksiz bir masraf gibi geliyordu. Ancak trafikte yaşananları gördükçe bir bursa araç kamerası taktırmanın lüks değil, ihtiyaç olduğunu anladım. Verdiğiniz bilgiler için teşekkürler.

Apartmanımızın otoparkı çok güvenli değil, daha önce birkaç aracın aynası kırılmıştı. Sadece sürüş anı değil, park halindeyken de aracımı koruyacak bir bursa araç kamerası benim için en doğru çözüm olacak gibi görünüyor.

Bu makale, bir bursa araç kamerası satın almadan önce nelere dikkat etmem gerektiğini net bir şekilde özetlemiş. Özellikle çözünürlük ve lens açısının önemini şimdi daha iyi anlıyorum. Emeğiniz için teşekkürler.

Bursa gibi büyük ve hareketli bir şehirde araç kullanmak ekstra dikkat gerektiriyor. Bir bursa araç kamerası kullanarak sadece kendimizi değil, trafikteki diğer masum sürücüleri de korumuş oluruz. Kesinlikle her araçta olması gereken bir cihaz.

Bu yazıyı okuyana kadar araç kameralarının bu kadar çok farklı özelliği olduğunu bilmiyordum. GPS takibi yapabilen bir bursa araç kamerası özellikle uzun yola çıkanlar veya aracını başkasına emanet edenler için büyük kolaylık.

Bu yazıyı okuyana kadar araç kameralarının bu kadar çok farklı özelliği olduğunu bilmiyordum. GPS takibi yapabilen bir bursa araç kamerası özellikle uzun yola çıkanlar veya aracını başkasına emanet edenler için büyük kolaylık.

Yazınızda bahsettiğiniz G-sensör özelliği çok mantıklı. Allah korusun bir kaza anında o paniğe kapılıp kaydı korumayı unutabiliriz. Bu özelliği olan bir bursa araç kamerası bakacağım, aydınlattığınız için sağ olun.

Yazın aracımızla uzun bir Karadeniz turu planlıyoruz. Yol boyunca hem güvenlik hem de hatıra olması için yüksek depolama kapasitesine sahip bir bursa araç kamerası edinmek istiyoruz. Bu yazı tam zamanında karşıma çıktı.

Yazınızı okuduktan sonra eşime hediye olarak bir bursa araç kamerası almaya karar verdim. Özellikle gece görüş kalitesinin iyi olması çok önemli. Bursa yollarında akşam saatlerinde sürüş yaparken ekstra bir güvence sağlayacaktır.

Bu makale, bir bursa araç kamerası satın almadan önce nelere dikkat etmem gerektiğini net bir şekilde özetlemiş. Özellikle çözünürlük ve lens açısının önemini şimdi daha iyi anlıyorum. Emeğiniz için teşekkürler.

Bu kameraların fiyatları hakkında biraz araştırma yapmıştım. Yazınızda belirttiğiniz özelliklere sahip, uygun fiyatlı bir bursa araç kamerası bulmak mümkün müdür? Fiyat/performans ürünü arayanlar için tavsiyelerinizi bekliyorum.

Çift yönlü kayıt yapabilen, yani hem yolu hem de aracın içini çeken bir bursa araç kamerası ticari taksiler için çok önemli. Hem sürücünün hem de yolcunun güvenliği için standart hale gelmesi gerektiğini düşünüyorum.

Değerli forum üyeleri, ben Bursa’da kendi ofisinde hizmet veren bir diyetisyenim. Sağlık alanında güven oluşturmak en önemli şey. Web sitemde sadece hizmetlerimi anlatmak yerine, insanların gerçekten faydalanacağı bilgiler paylaşmanın daha doğru olduğuna inanıyorum. “Bursa’da Kilo Verme Yöntemleri”, “PCOS ve Beslenme”, “Çocuklarda Sağlıklı Atıştırmalıklar” gibi konularda bilimsel temelli makaleler yayınlayarak hem mesleki bilgimi gösterebilir hem de danışan adaylarımın beni bulmasını sağlayabilirim. Kaliteli içeriğe dayalı bir Bursa SEO çalışmasının, en etkili ve etik pazarlama yöntemi olduğunu düşünüyorum.

Değerli arkadaşlar, ben Bursa’da faaliyet gösteren bir yeminli mali müşavirim. Bizim mesleğimizde reklam yapmak yasak ve etik değil. Ancak mükellefleri ve potansiyel mükellefleri bilgilendirmek serbest. Web sitemi bu amaçla kullanıyorum. “Yeni Şirket Kuruluşu ve Vergi Süreçleri”, “Bursa’daki KOSGEB Destekleri”, “e-Fatura’ya Geçiş Rehberi” gibi konularda makaleler yayınlıyorum. Bu sayede uzmanlığımı ortaya koyarken, internette araştırma yapan bir şirket sahibinin bana ulaşmasını sağlayabiliyorum. Bursa SEO, bizim gibi meslekler için en doğru dijital pazarlama yöntemidir.

Değerli arkadaşlar, ben Bursa’da faaliyet gösteren bir yeminli mali müşavirim. Bizim mesleğimizde reklam yapmak yasak ve etik değil. Ancak mükellefleri ve potansiyel mükellefleri bilgilendirmek serbest. Web sitemi bu amaçla kullanıyorum. “Yeni Şirket Kuruluşu ve Vergi Süreçleri”, “Bursa’daki KOSGEB Destekleri”, “e-Fatura’ya Geçiş Rehberi” gibi konularda makaleler yayınlıyorum. Bu sayede uzmanlığımı ortaya koyarken, internette araştırma yapan bir şirket sahibinin bana ulaşmasını sağlayabiliyorum. Bursa SEO, bizim gibi meslekler için en doğru dijital pazarlama yöntemidir.

Herkese merhabalar, forumda dijital pazarlama konularını takip ediyorum. Ben Bursa’da peyzaj mimarlığı yapıyorum, özellikle Bademli ve Balat tarafında villa bahçeleri tasarlıyorum. Benim işim tamamen görsel. Yaptığım bahçelerin fotoğraflarını Instagram’a ve siteme yüklüyorum ama bu bana yeterince yeni müşteri getirmiyor. İnsanlar genelde ‘tavsiye’ ile geliyor. İnternetten ‘Bursa bahçe tasarımı’ diye aratan potansiyel müşterilere bir türlü ulaşamıyorum. Son zamanlarda anladım ki, sadece fotoğraf yüklemek yetmiyormuş. Siteme ‘Bursa için Kış Bahçesi Bakım İpuçları’ veya ‘Küçük Balkonlar İçin Peyzaj Fikirleri’ gibi yazılar eklemem gerekiyormuş. Bu Bursa SEO meselesi sadece anahtar kelime yazmaktan çok daha derinmiş. Aramızda benim gibi proje bazlı ve görsel odaklı iş yapıp da web sitesinden verim alan var mı? Blog yazmak gerçekten de varlıklı müşteri kitlesine ulaşmada etkili oluyor mu? Tecrübelerinizi merak ediyorum.

İyi günler. Yıllardır Bursa’da sigorta acenteliği yapıyorum. Bizim işimiz tamamen güven ve birebir ilişki üzerine kuruludur. İnternet bize çok uzak bir dünyaydı. Ancak yeni neslin artık sigorta acentesini bile internetten aradığını görüyorum. “Bursa en uygun trafik sigortası” veya “tamamlayıcı sağlık sigortası tavsiyesi” gibi aramalarda neden ben çıkmayayım? Siteme sigortacılıkla ilgili temel bilgileri, hasar anında yapılması gerekenleri anlatan bir bölüm eklemeyi düşünüyorum. Bu bursa seo çalışmaları, geleneksel iş kollarının bile dijitalleşmek zorunda olduğunun bir kanıtı.

Selam arkadaşlar, Bursa’da bir oto galerim var. İnsanlar artık araba alırken önce internette saatlerce araştırma yapıyor. Sadece araba ilanları listelemek yetmiyor. Sitemize “İkinci el araba alırken nelere dikkat edilmeli?”, “Bursa’da noter satış işlemleri nasıl yapılır?”, “100.000 TL’ye alınabilecek aile arabaları” gibi rehber niteliğinde içerikler eklemeye başladık. Amacımız, insanlar araba alma karar sürecindeyken onlara yardımcı olmak ve güvenlerini kazanmak. Bu Bursa SEO yatırımı, uzun vadede bize sadık müşteriler olarak dönecektir diye umuyorum.

Selam arkadaşlar, Bursa’da bir oto galerim var. İnsanlar artık araba alırken önce internette saatlerce araştırma yapıyor. Sadece araba ilanları listelemek yetmiyor. Sitemize “İkinci el araba alırken nelere dikkat edilmeli?”, “Bursa’da noter satış işlemleri nasıl yapılır?”, “100.000 TL’ye alınabilecek aile arabaları” gibi rehber niteliğinde içerikler eklemeye başladık. Amacımız, insanlar araba alma karar sürecindeyken onlara yardımcı olmak ve güvenlerini kazanmak. Bu Bursa SEO yatırımı, uzun vadede bize sadık müşteriler olarak dönecektir diye umuyorum.

İyi günler. Yıllardır Bursa’da sigorta acenteliği yapıyorum. Bizim işimiz tamamen güven ve birebir ilişki üzerine kuruludur. İnternet bize çok uzak bir dünyaydı. Ancak yeni neslin artık sigorta acentesini bile internetten aradığını görüyorum. “Bursa en uygun trafik sigortası” veya “tamamlayıcı sağlık sigortası tavsiyesi” gibi aramalarda neden ben çıkmayayım? Siteme sigortacılıkla ilgili temel bilgileri, hasar anında yapılması gerekenleri anlatan bir bölüm eklemeyi düşünüyorum. Bu bursa seo çalışmaları, geleneksel iş kollarının bile dijitalleşmek zorunda olduğunun bir kanıtı.

İyi çalışmalar, biz Bursa’daki firmalara insan kaynakları ve personel seçme/yerleştirme danışmanlığı veriyoruz. Bizim iki hedef kitlemiz var: işveren firmalar ve iş arayan adaylar. Sitemizde hem “Bursa’daki şirketler için doğru personel bulma teknikleri” gibi işverenlere yönelik hem de “Mülakatta dikkat edilmesi gerekenler”, “Bursa’daki iş ilanları” gibi adaylara yönelik içerikler yayınlıyoruz. Bu çift taraflı Bursa SEO stratejisi sayesinde her iki kitleye de ulaşmayı ve aradaki köprü olmayı hedefliyoruz.

The examples really helped. 👉 Watch Live Tv anytime, anywhere — stream breaking news, top shows, and racing thrills on oneo tv.

https://shorturl.fm/0ydVB

https://shorturl.fm/47jwE

This should be featured everywhere. 👉 Watch Live Tv online in HD. Stream breaking news, sports, and top shows anytime, anywhere with fast and reliable live streaming.

https://shorturl.fm/dIiBG

siteniz harika vermiş olduğunuz makaleler için teşekkür ederim sitenize sürekli gelmek istiyorum başarılarınızın devamını bekliyorum

https://shorturl.fm/eNrDr

https://shorturl.fm/OxPVE

siteniz muazzam sürekli böyle paylaşım yapmanızı rica ediyorum

https://shorturl.fm/nhw8K

https://shorturl.fm/3v4yd